Trends in Uncoated Paperboard for Luxury Packaging Market 2026-35

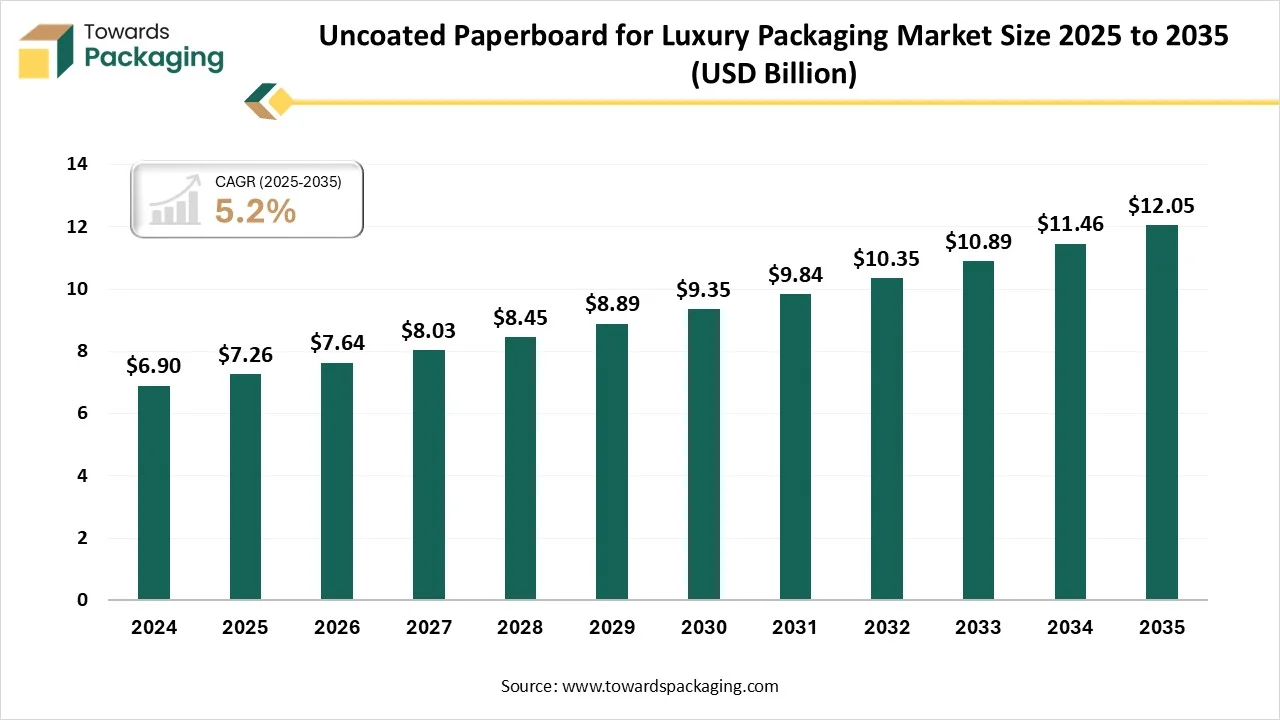

According to projections from Towards Packaging, the global uncoated paperboard for luxury packaging market is set to increase from USD 7.64 billion in 2026 to nearly USD 12.05 billion by 2035, reflecting a CAGR of 5.2% during 2025 to 2034.

Ottawa, Jan. 16, 2026 (GLOBE NEWSWIRE) -- The global uncoated paperboard for luxury packaging market, which stood at USD 7.26 billion in 2025, is projected to grow further to USD 12.05 billion by 2035, according to data published by Towards Packaging, a sister firm of Precedence Research. The market is growing due to rising demand for premium, sustainable, and natural-looking packaging that enhances brand authenticity and eco-conscious appeal.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Key Technological Shifts

- Advanced fiber engineering: Enhances durability while maintaining a smooth, high-quality tactile finish suitable for luxury brands.

- High-precision die-cutting and embossing: Enables complex shapes and fine detailing that elevate shelf appeal and brand differentiation.

- Water-based, soy-based, and low-impact printing technologies: Reduce environmental impact while delivering rich colors and sharp graphics.

- Chemical-free surface treatments: Preserve the natural, matte aesthetic preferred in premium packaging without compromising performance.

- Enhanced recyclability and composability: Supports circular economy goals and meets increasing sustainability regulations.

- Digital and short-run printing: Allows cost-effective personalization, faster design changes, and limited-edition luxury packaging launches.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5932

Market Overview

How is the shift toward sustainability driving growth in the luxury uncoated paperboard market for 2026?

The uncoated paperboard for luxury packaging market is witnessing growth propelled by the growing need for high-end, eco-friendly, and simple packaging options. To increase consumer trust and brand authenticity, luxury brands are moving toward natural textures and eco-friendly materials. Technological developments in paperboard strength, printing, and finishing enhance the attractiveness of the product. Stricter sustainability laws are also promoting broader adoption in upscale food, cosmetic, and fashion packaging.

Private Industry Investments for Uncoated Paperboard for Luxury Packaging:

- Stora Enso Oyj launched Ensovelvet, a new uncoated solid bleached sulfate (SBS) board designed specifically for luxury applications like cosmetics and perfumes, which emphasizes a natural, tactile feel to meet sustainability demands.

- Andhra Paper Limited received approval for a capital expenditure of INR 400 crores to rebuild and upgrade its existing pulp mill and install a new board machine with a capacity of approximately 175,000 TPA, positioning itself to meet the growing demand for sustainable packaging solutions.

- Sonoco Products Company has made significant investments in strengthening its uncoated recycled paperboard (URB) mill systems in the U.S. and Canada, with a major $83 million investment that aims to increase capacity and achieve substantial cost savings by optimizing operations.

- JK Paper Ltd. successfully started production at its new packaging board capacity during FY 2021-22, contributing to its range of virgin boards and specialty packaging paperboards that are popular with domestic and international brands.

-

Mondi Group has expanded its sustainable luxury packaging portfolio by using FSC-certified paperboard materials to meet the rising demand for eco-friendly, premium packaging solutions in key markets like Asia and India.

Uncoated Paperboard for Luxury Packaging Market Trends

- Tactile and Sensory Differentiation: Brands are increasingly using the natural, matte texture of uncoated paperboard to provide a premium "feel" that conveys authenticity and craftsmanship, which WestRock notes can encourage consumer engagement and higher sales. This trend is supported by finishing techniques like embossing and soft-touch coatings that mimic luxury materials like leather or velvet without using plastics.

- Strategic Minimalism and Material Efficiency: Modern luxury design is shifting toward "less is more," using high-quality uncoated substrates to eliminate excess layers and plastic components while maintaining a sophisticated aesthetic. This approach leverages the material's inherent sustainability credentials to build consumer trust, as shoppers often perceive simpler, fiber-based packaging as more premium and environmentally responsible.

-

Integration of Smart Technologies: Premium brands are embedding digital tools like QR codes, NFC tags, and RFID technology directly into uncoated paperboard to verify product authenticity and deepen post-purchase engagement. These "smart packs" allow for minimalist visual designs while providing a portal to exclusive digital content or blockchain-based tracking systems.

Market Opportunities

- Growing adoption of sustainable and plastic-free luxury packaging by global premium brands

- Rising demand for customized, limited-edition, and artisanal packaging designs

- Expansion of luxury cosmetics, perfumes, and premium food & beverage segments

- Increasing use of uncoated paperboard in high-end gifting and e-commerce packaging

- Brand storytelling through natural textures, embossing, and minimalist aesthetics

- Untapped growth potential in emerging luxury markets across the Asia Pacific and the Middle East

Segmental Insights

By Paperboard Grade/ Material Type

The virgin fiber uncoated paperboard segment is dominating the uncoated paperboard for luxury packaging market because of its exceptional strength, smooth surface, and high-end tactile feel, which make it perfect for applications involving luxury packaging. Virgin fiber boards are preferred by brands in the cosmetics, perfume, and high-end confectionery industries because of their strength and capacity to support complex designs, foil stamping, and embossing, all of which enhance the opulent brand image.

The recycled uncoated paperboard segment is growing rapidly as luxury brands increasingly consider sustainability. Recycled materials are being adopted without sacrificing quality or a premium appearance due to growing consumer demand for eco-friendly packaging and regulatory pressure to reduce plastic use.

By Product/Packaging Format

The rigid boxes (setup / magnetic boxes) segment is dominating the uncoated paperboard for luxury packaging market because of its sturdy construction and capacity to improve the unboxing experience. High-end goods like perfumes, cosmetics, and designer accessories are frequently packaged in these formats because they provide superior protection and a high-end appearance.

The display & presentation packaging segment is growing rapidly, motivated by luxury brands with emphasis on eye-catching store displays and limited-edition collections. In this market, creative designs enable brands to establish a memorable shelf presence and increase customer engagement. Brands are being forced to use innovative paperboard packaging solutions due to the growing demand for interactive and eye-catching displays.

By End Use/ Luxury Segment

The cosmetics & fragrances segment is dominating the uncoated paperboard for luxury packaging market as high-end skincare, makeup, and fragrance products depend more on premium uncoated paperboard for elegant packaging. Growing consumer demand for beauty products worldwide and the demand for robust eye-catching packaging that reflects premium brand positioning both benefit this market. The beauty industry's regular product launches and seasonal packaging editions also contribute to the segment's expansion.

The gourmet foods & confectionery segment is growing rapidly, driven by the need for sophisticated packaging for high-end snack items, chocolates, and confections. Uncoated paperboard is increasingly being used by brands to produce eco-friendly gift-worthy packaging that appeals to wealthy customers. Adoption in this market is accelerated by limited-edition and celebratory packaging trends.

By Distribution Channel

Direct sales to the luxury brands segment dominate the uncoated paperboard for luxury packaging market, as they provide specialized packaging solutions; manufacturers and converters concentrate on forming solid alliances with luxury brands. Customized designs, quality assurance, and high-end finishing options that satisfy brand standards are made possible by direct collaborations. This strategy guarantees long-term connections with high-end customers and brand-specific innovations.

The online / e-commerce packaging platforms segment is growing rapidly, reflecting the growing trend of luxury goods being sold online. E-commerce necessitates packaging that is both aesthetically pleasing and robust enough to safeguard expensive goods during transportation, spurring the development of high-quality protective uncoated paperboard solutions. The demand for specialized packaging formats is further driven by the expansion of online luxury retail in emerging markets.

More Insights of Towards Packaging:

- Sustainable Flexible Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Pharmaceutical Cold Chain Logistics Packaging Market Size, Trends, Segments, Regional Outlook, and Competitive Landscape 2025-2035

- Canned Glass Packaging Market Size, Share, Trends, and Forecast 2025-2035

- U.S. Custom Cardboard Boxes Market Size, Trends, Segments, Regional Outlook, Competitive Landscape & Trade Intelligence Report

- Bioengineered Packaging Market Size, Trends, Segments, Regional Insights, and Competitive Landscape 2025-2034

- North America Insulated Packaging Market Size, Trends, Segments, Regional Insights, and Competitive Landscape 2025-2034

- Reusable Water Bottles Market Size, Share, Trends, Segments and Forecast 2035

- Dog Food Container Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape, and Trade & Supply Chain Insights

- Australia Vacuum Sealer Bags Market Size, Trends, Segments, Competition & Trade Analysis

- Sterile Medical Paper Packaging Market Size, Trends, Segmentation, Regional Outlook (NA, EU, APAC, LA, MEA), Competitive Landscape & Trade Analysis

- U.S. Vacuum Sealer Bags Market Size, Trends, Segmentation and Competitive Landscape 2025-2034

- Packaging Inks and Coatings Market Size, Trends, Regional Insights, and Competitive Landscape 2025-2034

- IBC Tanks Market Size, Share, Trends, Regional Analysis, and Competitive Landscape 2025-2034

- Metallized Rollstock Film Market Size, Share, Trends & Forecast 2025-2035

- Shipping Labels Market Size, Trends, Segments, Regional Insights, and Competitive Landscape Analysis 2025-2034

- Mono-material Plastic Packaging Film Market Size, Trends, Segmentation, and Competitive Landscape 2025-2034

- Sustainable Pharmaceutical Packaging Market Size, Trends, Segments, Regional Insights, and Competitive Landscape 2025-2034

- Clarified Polypropylene Bottles Market Size, Trends, Segments, Regional Outlook (NA, EU, APAC, LATAM, MEA), Competitive Analysis, Manufacturers and Trade Data

By Region

Europe is dominating the uncoated paperboard for luxury packaging market due to the existence of well-known luxury brands, cutting-edge production techniques, and a focus on premium and environmentally friendly packaging options. Demand is maintained by the area's emphasis on fine craftsmanship, high-end design, and environmentally friendly initiatives. Furthermore, the use of premium recyclable paperboards for luxury goods is encouraged by stringent packaging laws in Europe.

Germany Uncoated Paperboard for Luxury Packaging Market Trends

Germany's market for luxury packaging is growing as premium brands increasingly prioritize sustainability, opting for recyclable, natural-looking materials that align with eco-conscious consumer expectations. High demand in the luxury goods sector, especially cosmetics, fashion, and specialty foods, is driving innovation in paperboard grades that offer both aesthetic appeal and structural performance without coating.

Asia Pacific is the fastest-growing region, driven by the growth of the middle class, rising e-commerce penetration, and rising luxury consumption. Demand for high-end packaging in the gourmet food, cosmetics, and gift industries is rising in these nations. Luxury packaging solutions are becoming more popular in these nations due to their fast urbanization and rising disposable income.

China Uncoated Paperboard for Luxury Packaging Market Trends

China's market for luxury packaging is expanding steadily as premium brands respond to rising environmental awareness and stricter national sustainability and waste-reduction policies by shifting towards recyclable, fiber-based materials. Strong growth in luxury sectors such as cosmetics, premium beverages, confectionery, fashion accessories, and high-end gifting is increasing demand for uncoated paperboard that delivers a refined, natural aesthetic while maintaining strength and rigidity.

Recent Developments in the Uncoated Paperboard for Luxury Packaging Industry:

- In September 2025, Stora Enso launched Ensovelvet, a premium uncoated solid bleached sulfate (SBS) board with a velvet-like surface for luxury packaging in cosmetics, fragrances, and other high-end goods, combining natural texture with excellent stiffness and recyclability. The new board also supports high-quality embossing and foil stamping, enhancing brand appeal.

- In April 2025, Mondi showcased expanded sustainable uncoated papers tailored for luxury packaging, including 350 g/m² grammage ideal for perfume packaging, at LUXE PACK Shanghai 2025. These papers offer improved print fidelity and tactile finishes, catering to premium branding requirements.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Top Companies in the Uncoated Paperboard for Luxury Packaging Market & Their Offerings:

- Metsä Board Corporation: Offers high-yield, sustainable fresh fiber paperboards.

- WestRock Company: Leading provider of sustainable fiber-based packaging.

-

ITC Limited: Provides eco-friendly, high-end rigid packaging boards.

Other Players

- Mondi Group plc

- International Paper Company

- DS Smith Plc

- Holmen Iggesund

- Nippon Paper Industries Co., Ltd.

- Amcor Plc

- Graphic Packaging Holding Company

- Mayr-Melnhof Group

- Sappi Limited

- Billerud AB

- Packaging Corporation of America (PCA)

- Oji Holdings Corporation

- Smurfit Kappa Group

Segments Covered in the Report

By Paperboard Grade / Material Type

- Virgin Fiber Uncoated Paperboard

- Recycled Uncoated Paperboard

- Solid Bleached Sulfate (SBS)

- Folding Boxboard (FBB)

- White Lined Chipboard (WLC)

- Coated Unbleached Kraft (CUK

By Product / Packaging Format

- Rigid Boxes (Setup / Magnetic Boxes)

- Folding Cartons

- Sleeves & Wraps

- Paper Bags

- Labels & Tags

- Display & Presentation Packaging

By End-Use / Luxury Segment

- Cosmetics & Fragrances

- Watches & Jewelry

- Premium Beverages (Spirits & Wine)

- Fashion & Accessories

- Consumer Electronics

- Gourmet Foods & Confectionery

By Distribution Channel

- Direct Sales to Luxury Brands

- Packaging Converters / OEM Partnerships

- Distributors & Wholesalers

- Online / E-commerce Packaging Platforms

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

- GCC Countries

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5932

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Auto | Towards Food and Beverages | Towards Chemical and Materials | Towards ICT | Towards Dental | Towards EV Solutions | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Towards Packaging Releases Its Latest Insight - Check It Out:

- Certified-Circular Plastic Market Analysis and Regional Outlook (2026–2035)

- PE-Free Wrappers Market Size and Segments Outlook (2026–2035)

- Agricultural Films Market Size, Trends, Segments, Regional Insights & Competitive Landscape 2025-2034

- Automotive Plastic Compounding Market Size & Business Model Innovation

- Molded Pulp Packaging Market Size, Trends, Segments, Regional Outlook & Competitive Landscape Analysis

- Plastic Healthcare Packaging Market Size, Trends and Segments (2026–2035)

- Liquid Carton Packaging Market Size, Trends and Segments (2026–2035)

- Sustainable Foodservice Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Micro Packaging Market Size and Segments Outlook (2026–2035)

- Bottle Caps Market Size, Trends and Competitive Landscape (2026–2035)

- Cosmetic Packaging Machinery Market Size and Segments Outlook (2026–2035)

- Highly Visible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Returnable Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Beer Cans Market Size, Trends and Regional Analysis (2026–2035)

- Tube Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Shrink and Stretch Sleeve Labels Market Size and Segments Outlook (2026–2035)

- Barrier Films Packaging Market Size and Segments Outlook (2026–2035)

- Cups and Lids Market Size, Trends and Segments (2026–2035)

- Rigid Bulk Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Flexible Intermediate Bulk Container (FIBC) Market Size, Trends and Segments (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.